Opentech is a PCI DSS Service Provider

Level 1 (unlimited transactions)

Annually assessed by a Qualified Security Assessor (QSA)

Company recognised by the PCI Council

Form submitted, your download will start soon.

Level 1 (unlimited transactions)

Annually assessed by a Qualified Security Assessor (QSA)

Company recognised by the PCI Council

We have the privilege of working with some of the most well known banks in the world and we don’t take this lightly.

Leveraging our product and services, our clients can provide their customers with reliable and effective services.

We view our clients as partners and work collaboratively with them in order to achieve results that they can measure.

AutomatID™ service is the solution designed by Opentech to strongly identify users by enabling identity validation methods through the NFC technology. In this way it is possible to unload labor-intensive channels (Customer Centers, physical branches or cumbersome paper-based procedures) and drastically speed up the process. The service can be used as a first identification or to re-identify a user in case they cannot remember their credentials.

AutomatID™ enables ID documents validation on both iOS and Android devices and payment cards validation on Android devices.

Would you like to know more? Visit our AutomatID™ portal

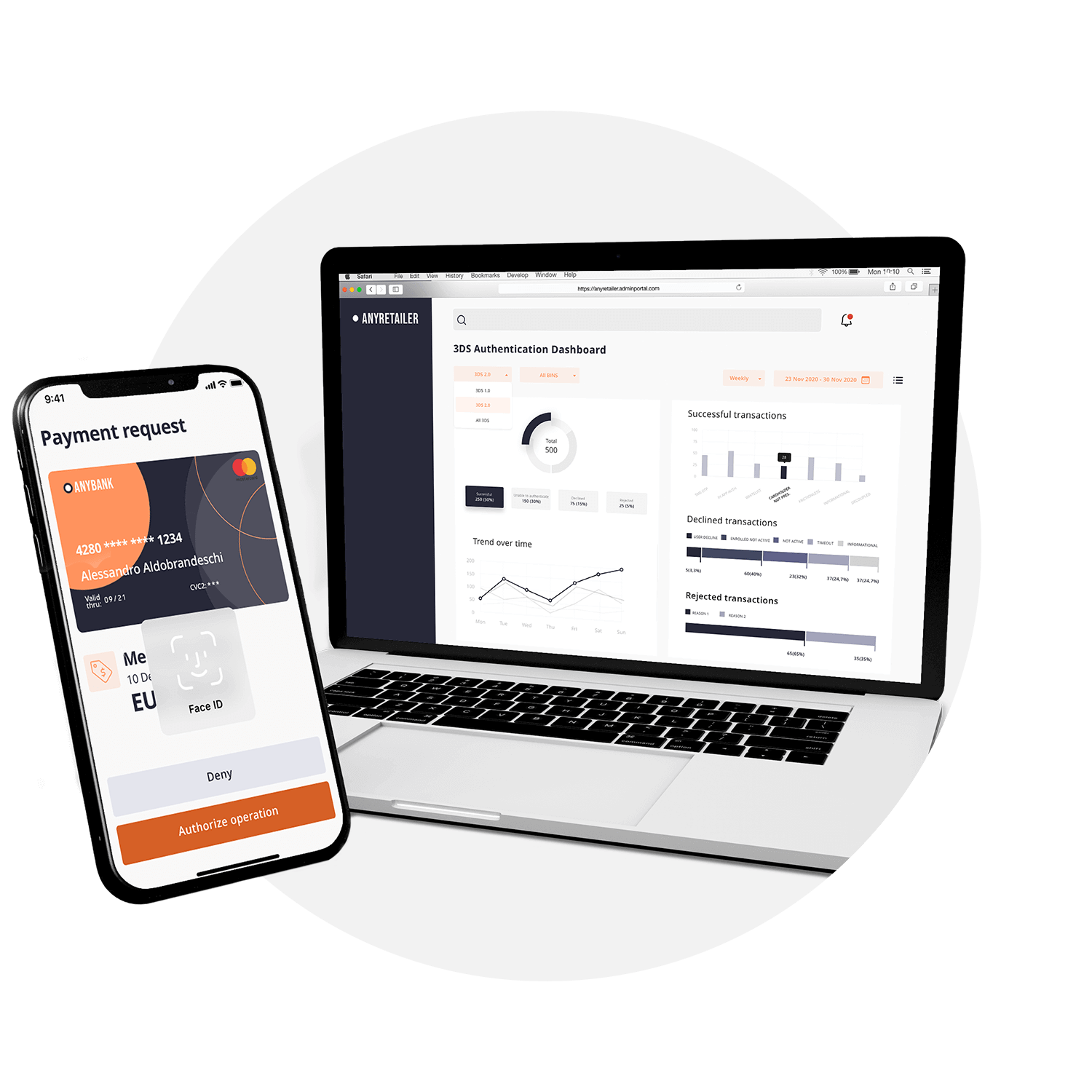

Nowadays the explosive growth of e-commerce services has made the protection of online payments crucial for the business of a card issuer. In this scenario, a critical success factor is the availability of 3DS authentication services that are trustworthy, secure and able to not compromise the quality of the shopping experience of the Customers. OpenPay™ ACS is the State-of-the-Art 3DS authentication technology designed by Opentech to meet these needs in a distinctive way.

Find out more downloading our presentation

OpenPay™ Send by Opentech is the first European solution in the world that

integrates both the Mastercard Cross Border and the Mastercard Person-to-Person APIs into a

seamless product experience.

Available both as a stand-alone solution or as an SDK (mobile and web), OpenPay™ Send

allows you to reach more than three billion bank accounts in about 100 countries, as well as

multiple end-points including mobile wallets, payment cards and cash-out locations across the

globe.

Find out more downloading our presentation

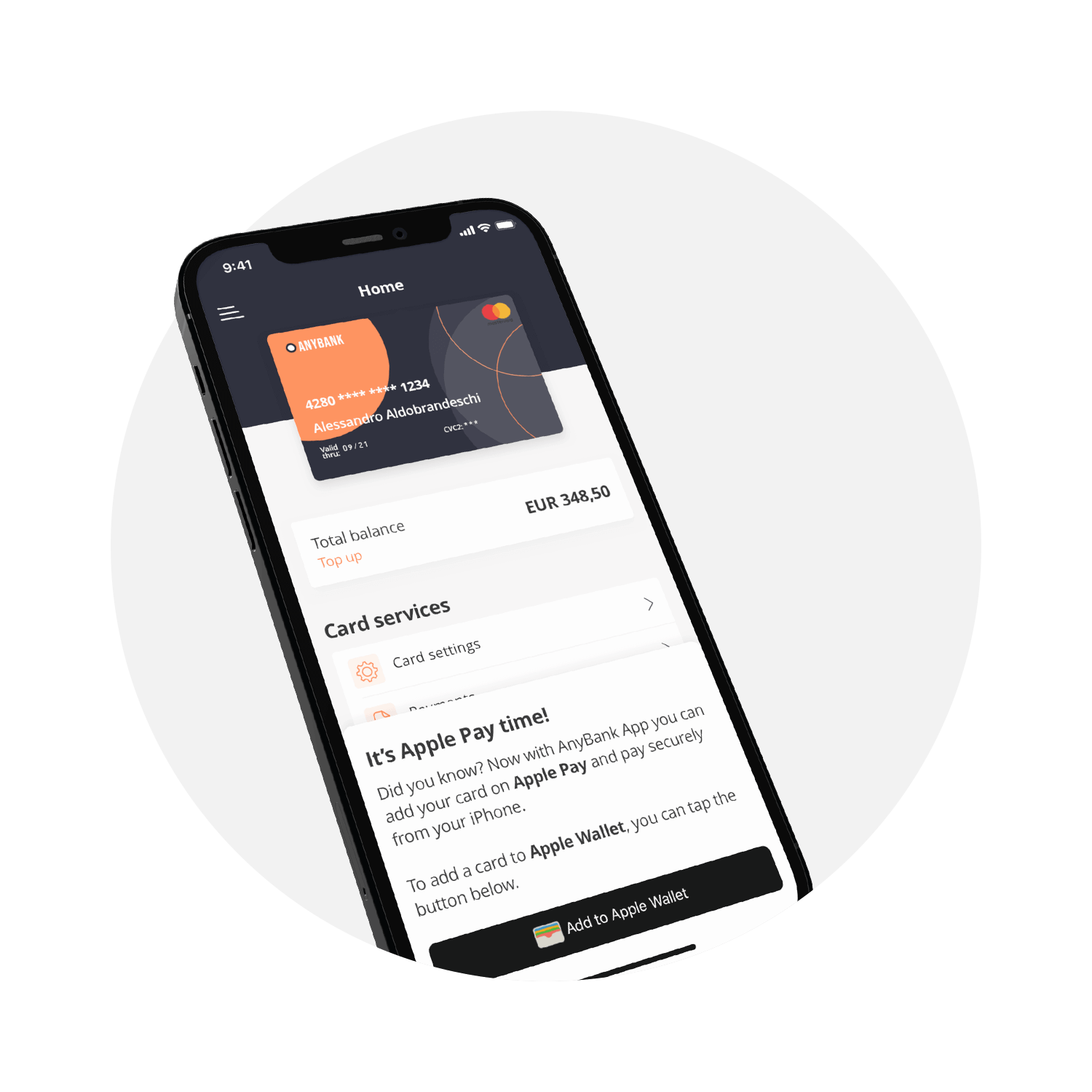

The natural evolution of payment digitization will lead to a massive use of card

tokens within wallets hosted on mobile and wearable devices (Apple Pay, Samsung Pay, Garmin Pay,

etc.), as well as in merchants’ applications (Amazon, Netflix etc.).

In such a context the OpenPay™ Card Tokenization Services allow Card Issuers’ apps and

web portals to lead this change, assuming a key role for the card-token generation and management.

The core module of this solution includes services for the digitization of cards on

third-party wallets (including Apple Pay, Samsung Pay and Google Pay, for both in-app Provisioning

and In-App ID&V) and Card issuer proprietary HCE wallets (only available for Android devices with

NFC capabilities).

The solution is completed by a management console that allows users to know at any time where

their cards have been tokenized (on both merchant apps and devices) and to easily handle them by

temporarily blocking or removing them directly from the Issuer’s app.

Find out more downloading our presentation

OpenPay™ Wallet, the mobile wallet service operated by Opentech, is the most complete wallet solution available on the market. The service includes both wallet server and mobile apps for iOS & Android, featuring a Strong Customer Authentication tool compliant with EBA guidelines and European regulations.

OpenPay™ Wallet has already been chosen by Swiss Bankers and BNL (BNP Paribas Group) for their mobile payment solutions.

OpenPay™ Strong Customer Authentication (SCA) is the Opentech solution for the management and generation of cryptograms in form of One Time Passwords (OTPs) used to provide a Strong Customer Authentication.

Already in use as a multi factor, transaction signing and authentication system for major European Banks and Card Issuers, OpenPay™ SCA is the solution that turns any iOS or Android smartphone into a digital Token that combines bank-level security standards with outstanding user experience.

OpenPay SCA can authenticate and authorize any operation using a single PIN Code defined by the user, so as to minimize the cognitive effort required during the signature process. The PIN Code can also be completely replaced by biometric identification, making it even easier to use OpenPay SCA for any operation.

The product is compliant with PSD2 requirements for Strong Customer Authentication and 3DS requirements.

Leveraging over ten years of experience in this market, Opentech has built a framework for the development of e-banking products that includes technologies, processes and best practices tailor-made for the financial ecosystem.

The OpenPay™ Banking Framework, already adopted by major European Banks including ING and UniCredit, aims to make the most of the peculiarities of each device, enabling use cases optimized for each context of use and ensuring a best-in-class Banking Experience.

Find out more downloading our presentation

Opentech Secure Concierge is a generative AI-powered chatbot designed to enhance customer support operations for banks and card issuers. By leveraging a multi-LLM architecture, it ensures intelligent query handling while maintaining the highest standards of security and compliance. Unlike traditional AI solutions, it does not lock institutions into a single provider and guarantees that no personal data is exposed to external LLM services, thanks to its proprietary data anonymization engine and real-time data sanitization.

The solution seamlessly integrates into existing banking infrastructures and digital channels, enabling financial institutions to deliver a fast, reliable, and secure customer support experience. Built with compliance in mind, it meets key industry standards, including PCI DSS, PCI 3DS, ISO 27001, EBA guidelines, GDPR and FINMA regulations, ensuring that institutions can deploy AI-driven automation while adhering to strict security and data protection requirements.

Opentech Secure Concierge serves multiple use cases. It helps customers discover financial products by answering questions about available credit cards, fees, and features. It provides instant support for common inquiries such as checking a balance or retrieving a transaction history. It also offers spending insights, allowing users to analyze their expenses and gain a clearer understanding of their financial habits. Beyond that, it can be configured by the user to , and sends proactive alerts, notifying users of important account updates, such as low balances or unusual transactions.

By implementing this solution, banks and card issuers can significantly reduce Level 1 support costs, while improving response times. At the same time, they ensure compliance with the highest security standards and benefit from a system designed for scalability, making it adaptable to various regulatory environments.

With its deep expertise in financial security and digital transformation, Opentech has developed Secure Concierge as a solution that not only enhances efficiency but also elevates the customer experience, providing smart, secure, and frictionless customer support.

Opentech offers talented candidates the opportunity to

take part in the future of mobile finance applications.

We are continuously looking for high-potential people to join our international network.

For any inquiry write us or call us

Email:

info@opentech.com

Mühlegasse 18

6340 Baar - Switzerland

+41 415 880 195

Via Copernico, 38

20125 Milan - Italy

+39 02 947 521 39

Viale Luigi Schiavonetti, 286

00173 Rome - Italy

+39 06 8635 7037 / +39 06 4549 0355