AutomatID™

Smart Technology for

Smart Identifications

Identify your Customers securely and quickly through the NFC technology

AutomatID™ combines banking-level security standards with full-digital processes to provide you with the easiest, fastest and most secure Strong Customer Identification service ever seen.

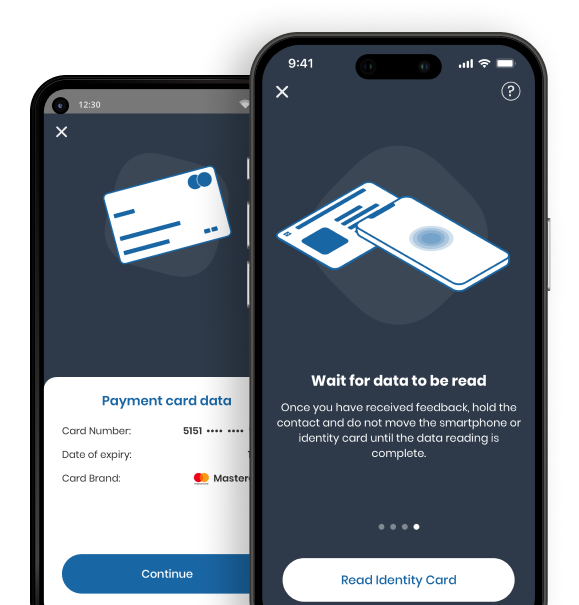

Already adopted by major European Banks, OpenPay SCI leverages the NFC technology available on all modern smartphones to identify users by reading their ID documents (identity cards, passports) and / or payment cards.

This way you can say goodbye to the cumbersome processes based on paper documents, video identifications or showing up in person.

Scan the MRZ Code print on the document (passport or Identity Card)

Tap and read it with your smartphone

Perform a liveness check

Wait for identification response

Done!

Scan the payment card with the smartphone

Wait for identification response

Done!

AutomatID™ reshapes the Customer Experience through a simple, full-digital process to be invoked every time you need to identify with absolute certainty who is interacting with your products

Verifying the age of users is crucial for services like adult content portals, video games with in-game currency, betting and gambling platforms, etc. AutomatID performs this check instantaneously, thus allowing users to continue using the service in a few seconds.

Online services increase their value when a responsible use is ensured. This is especially true in the case of platforms that connect users with professionals (doctors, teachers, plumbers, etc.): leveraging AutomatID it is possible to build products where both the statements made by professionals and the user reviews have been shared by real and identified people.

Thanks to AutomatID, Financial Institutions can significantly increase the security of their payment platforms by accurately verifying that the accounts belong to the legitimate owners of the payment tools. This results in a drastic reduction of frauds while increasing the trustability of the system.

The onboarding of new customers often requires, for compliance with national / international regulations, to collect certain information about the users who are registering for the service. In this context AutomatID provides a best in class experience based on a full-digital process that will drastically reduce the abandonment rate.

The credentials that users generally use to access and use their favorite services can sometimes be compromised: forgotten PINs and passwords, blocking situations caused by entering the wrong credentials for too many attempts, etc. In these cases AutomatID can be used as a credential recovery system allowing users to go back to their services in seconds.

AutomatID can be used as a dynamic layer of protection to be activated in real time to instantly secure a system and thus ensure business continuity. This protection is particularly suitable for situations of distributed telematic attack; once activated, AutomatID is able to guarantee that the users who access the system are identified and authorized.