-

15/09/2025

Laying the Foundation for an Open and Scalable Swiss Payment Ecosystem

Viseca, a well-established player in the Swiss card payments industry, and Opentech, a pan-European provider of digital payment solutions, today announced a strategic partnership aimed at developing an open and interoperable platform tailored to the Swiss market. The initiative places cross-border peer-to-peer (P2P) money transfers at the heart of its mission.

The collaboration responds to a growing trend: cardholders increasingly rely on third-party providers to send instant payments abroad. This indirect route often leads to fragmented customer experiences and diminished control for issuing banks. The new platform addresses this challenge by allowing financial institutions to offer their customers a direct and user-friendly solution for international payments. It is designed to be secure, fast, and accessible across borders.

“We believe it is our responsibility to empower our partner banks with solutions that not only reflect technological progress but also deliver tangible value to their customers,” said Stefan P. Brunner, CPO at Viseca. “By enabling cross-border payments directly via the client’s payment card, banks can strengthen customer loyalty and reduce reliance on external providers. Together with Opentech, we are laying the foundation for an ecosystem that makes this vision a reality.”

Stefano Andreani, CEO of Opentech, added: “Our platform is designed to be open and scalable, with a clear focus on fostering interoperability between banks, card issuers, and international payment networks. Through our partnership with Viseca, we are optimizing the platform around the real needs of Swiss issuers, issuing banks and their customers. The solution is engineered for usability, effectiveness, and customer-centric value creation.”

-

05/05/2025

Opentech joins the ECB’s Pioneer programme for the digital euro

We are pleased to share that Opentech’s application to the European Central Bank (ECB)’s Digital Euro Innovation Platform has been accepted. As part of the “Pioneers” workstream, we join over 70 organisations from across Europe exploring use cases for the digital euro.

Following the ECB’s call for expressions of interest in October 2024, Opentech’s application was accepted alongside those of other prestigious Italian institutions — including Politecnico di Milano, SDA Bocconi School of Management, and ABI Lab — highlighting the strong national contribution to this European initiative.

As a Pioneer, Opentech will contribute to the development of the digital euro by testing conditional payments and integrating ECB-provided interfaces into its platform. This hands-on experimentation will culminate in a report to the ECB, sharing insights and suggestions to help shape the future of the initiative — which has the potential to enrich Europe’s payment landscape with new, trusted and flexible tools.

For Opentech, this participation is a natural extension of our long-standing commitment to building open, interoperable solutions that respond to evolving market needs — contributing to a payment ecosystem where digital euro infrastructure and global card networks work together to offer greater flexibility, accessibility and continuity for users.

-

18/09/2024

Opentech Digital Services S.p.A.: A Further Step in our Growth Journey

We are pleased to announce a significant step in the ongoing evolution of Opentech: Opentech Software Engineering s.r.l., the Rome-based headquarters of the Opentech group, has officially transitioned into Opentech Digital Services S.p.A.. This change was completed during August 2024 and marks an important milestone in our journey of growth and governance enhancement.

Why the Name Change?

The new name, Opentech Digital Services, reflects the expansion of our service offerings over the years. We have evolved far beyond our original focus on software development, and today we manage the complete lifecycle of digital projects—from design and implementation to ongoing operational management. Our solutions are tailored to the needs of the international banking sector, with a focus on digital payment services and cutting-edge digital banking solutions. Of course, despite these changes, we remain Opentech at heart. Our name continues to reflect our core commitment to open technologies—ensuring that our solutions offer flexibility, interoperability, and freedom from technological lock-ins. This philosophy continues to guide everything we do, empowering our clients to scale and adapt without constraints.

Why the Transition to S.p.A.?

Becoming a S.p.A. (Società per Azioni - Joint-Stock Company) is a natural progression for us as we continue to grow and strengthen our corporate structure. This transition enhances transparency, governance and accountability, providing a solid foundation as we continue to support our partners and stakeholders globally. Our ownership remains deeply committed to Opentech’s long-term vision and growth: with unwavering dedication, they continue to invest in the company’s success, ensuring stability and the pursuit of new opportunities for innovation. No changes to the ownership structure are planned, as we remain focused on driving the company forward together.

Reinforcing Governance: Introducing the Board of Statutory Auditors

As part of this transition, we have also strengthened our internal governance by appointing a Board of Statutory Auditors, led by President Dr. Carlo Cantalamessa, with members Dr. Jacopo Pescosolido and Dr. Jacopo Nardi. These highly qualified, independent professionals will oversee our financial reporting and ensure the accuracy of our accounts, reinforcing our commitment to transparency and trust. Their role is crucial in supporting our continuous efforts to maintain the highest standards in governance.

What This Means for You

Whether you are a client, supplier, partner, or stakeholder, we want to assure you that this evolution has no impact on existing agreements. All contracts remain in force: all other legal, fiscal and administrative details of the company remain unchanged. We believe this new chapter will reinforce our governance and bolster our capacity to deliver exceptional solutions, creating even greater value for all our stakeholders. This transformation reflects our commitment to continuous improvement and growth, and we look forward to sharing our ongoing progress in the near future.

-

15/07/2024

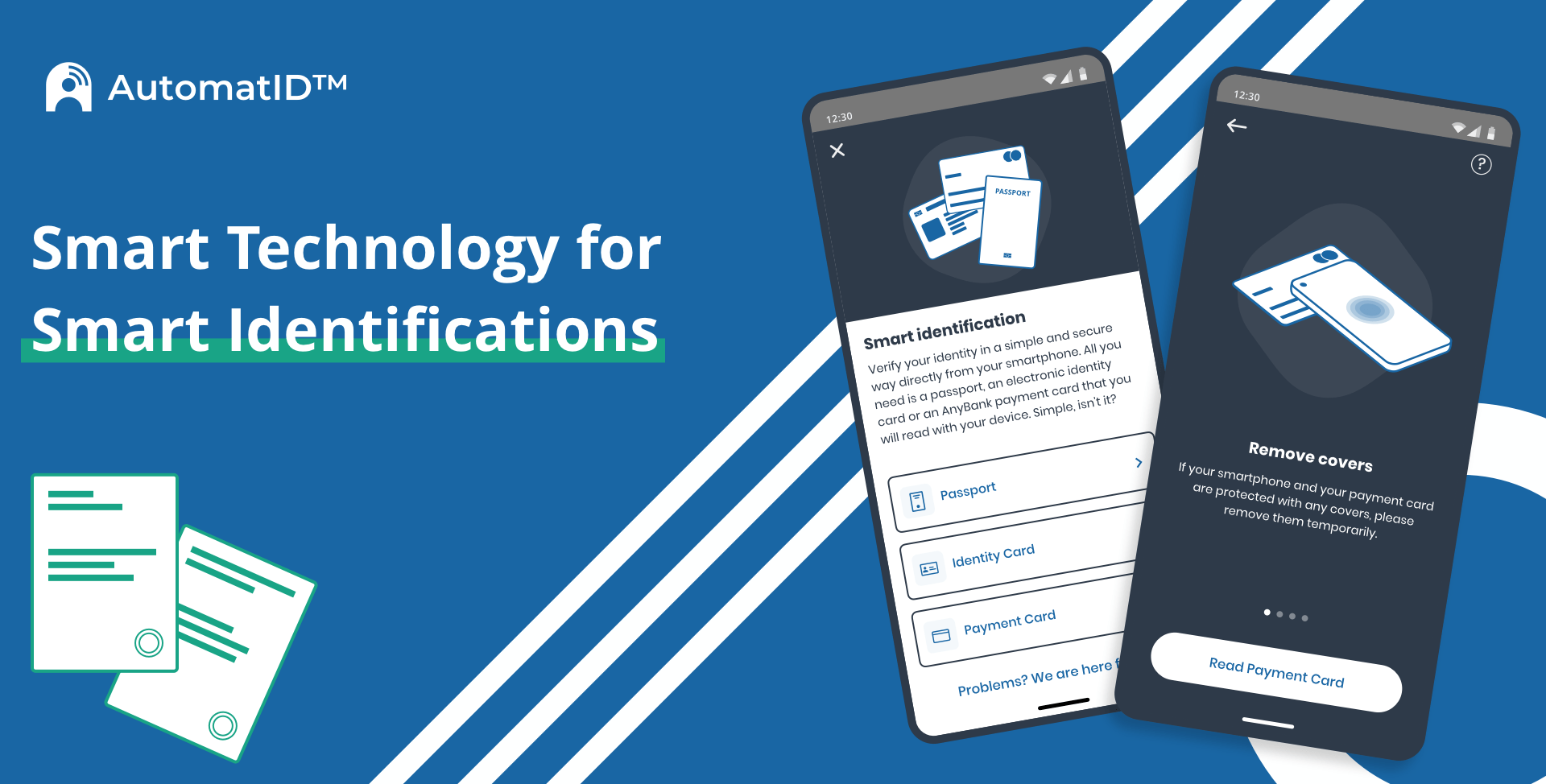

AutomatID™ now Available on AWS Marketplace: Welcome to the Smart Identification Era

Identifying users with certainty is crucial for any Company.

Whether it's onboarding new customers, verifying the identity of professionals leaving reviews, preventing fraud, ensuring users meet age restrictions for certain content, or recovering compromised credentials like PINs or forgotten passwords—accurate user identification is essential.

The problem? Traditional identification processes are outdated and cumbersome. Filling out forms, attaching copies of documents, and sending them via regular mail; spending hours on the phone with customer service; or, even worse, having to visit physical locations—all of these methods create frustration and risk losing customers.

At Opentech, we believe these outdated processes need to be a thing of the past. That’s why we're excited to introduce AutomatID™, our cutting-edge, fully digital identification service. With AutomatID™, all you need is an NFC-enabled smartphone to securely and accurately read an ID document or payment card—no paperwork, no hassle.

AutomatID™ is available as an easy-to-integrate plug-in for any iOS or Android app, requiring minimal development effort. Once embedded, it can be used whenever you need to verify the identity of a user interacting with your products—whether it’s for customer onboarding, resetting a PIN, or unlocking a blocked account.

The entire operation is secured end-to-end using asymmetric key cryptographic protocols, ensuring that the process is tamper-proof and non-repudiable. This guarantees the highest level of security, giving you peace of mind that your users' identities are protected.

Join the smart identification revolution and enhance your app’s user experience with AutomatID™. You can purchase a license on AWS Marketplace.

For more information, visit the website.

-

29/02/2024

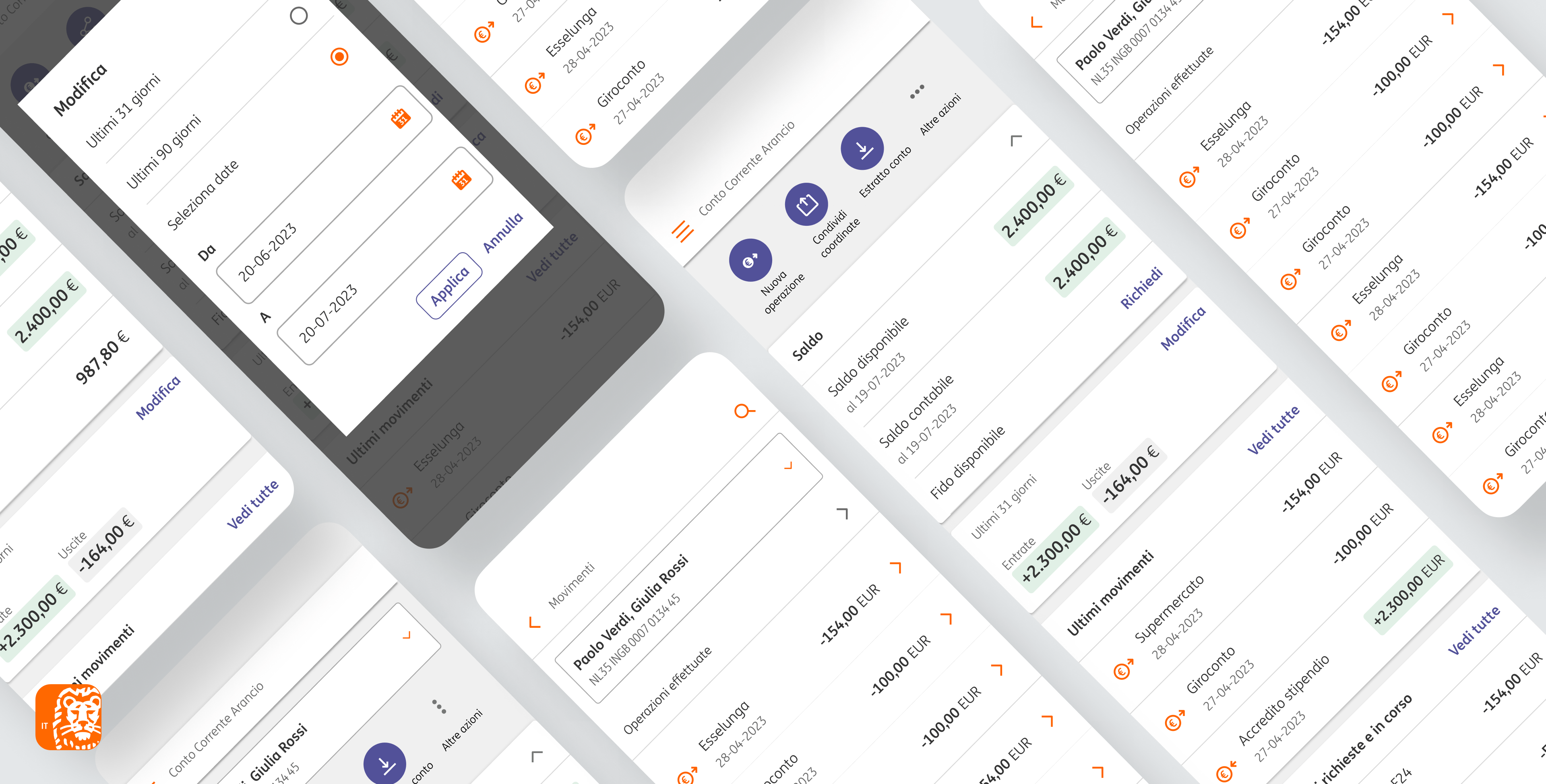

New ING Mobile Apps Now Available on App Stores

Opentech announced the launch of the newly redesigned ING mobile apps, now available on the App Store and Play Store. This latest version of the ING mobile app represents a significant update, enhancing both aesthetics and functionality.

In terms of aesthetics, the redesign aligns the app’s visual identity with ING Group’s new international branding guidelines, ensuring a consistent and unified customer experience across all digital channels globally.

Building on this visual transformation, the new app introduces functional upgrades that enhance how users interact with their financial products. Central to these improvements is the completely redesigned home screen, which now provides instant access to key information about ING products and personalized promotions.

In addition to the revamped home screen, the app features a streamlined navigation system designed to simplify access to essential product details and operational features. This improvement enhances the fluidity of daily banking activities, allowing users to perform tasks such as checking balances or initiating transactions more quickly and efficiently.

Moreover, the app now displays the real-time difference between income and expenses for each account, offering users a clear snapshot of their financial health directly within their banking product details.

Beyond these functional upgrades, the mobile app continues to serve as the Strong Customer Authentication (SCA) system for all ING Italy digital channels, leveraging the OpenPay™️ SCA module—Opentech’s solution for managing and generating cryptograms in the form of One-Time Passwords (OTPs).

The ING redesign was the result of Opentech’s multidisciplinary approach, where UX and UI experts worked in close collaboration with technical teams throughout the entire project lifecycle. This teamwork ensured the seamless integration of aesthetics, functionality, and security, resulting in a distinctive, best-in-class mobile banking experience.

-

17/02/2022

Opentech joined the Mastercard Send Program

Opentech marks another important milestone on its path: our Company is one of the first 16 technology players in the world to have been chosen by Mastercard to support the launch of the new Mastercard Send Program.

Officialized yesterday with a press release from Mastercard, the initiative encourages networking between Banks, Issuers and leading financial technology providers to shape the future of a modern, secure and effective platform for digital payments and to transfer money domestically and abroad.

Opentech joined the Program with OpenPay™ Send, a solution that merges both Mastercard Send and Mastercard Cross-Border APIs into a best-in-class, fully customizable product that can be quickly deployed without requiring a complex integration.

Available both as a stand-alone solution or as a Plug-in (mobile and web), OpenPay™ Send enables access to a business with unprecedented growth perspectives leveraging a platform that can reach more than three billion bank accounts in about 100 countries, as well as multiple end-points including mobile wallets, payment cards and cash-out locations across the globe.

-

25/08/2021

OpenPay™ ACS certified EMV

OpenPay™ ACS, Opentech's state-of-the-art 3DS authentication technology for card Issuers, is now certified by EMVco for 3DS 2.x authentications.

The solution is the result of a perfect combination of an outstanding User Experience and the convenience of a SaaS model.

OpenPay™ ACS takes care of the whole 3DS authentication process (receiving 3D Secure messages, processing the messages, authenticating the cardholder, generating the authentication value), providing the end-users with an unparalleled online-purchase experience in terms of security, convenience, and ease of use. In fact, in addition to the traditional authorization via SMS OTPs and static password, OpenPay™ ACS provides an Out of Band alternative with biometric recognition that turns the customers' smartphones into signing devices for online payments, thus eliminating both the SMS’ costs for the Issuer and the pain points for the users (waiting time, memorization and typing of OTPs).

OpenPay™ ACS, available as-a-service with minimal IT integration efforts for the Issuers, is a scalable platform that has been designed to ensure reliability and service continuity also in case of unexpected or predictable peak loads (e.g. Black Friday or Christmas shopping).

“OpenPay™ ACS is the ideal choice for Banks and Card Issuers looking for a reliable, efficient and always up-to-date solution.” said Stefano Andreani, CEO of Opentech.

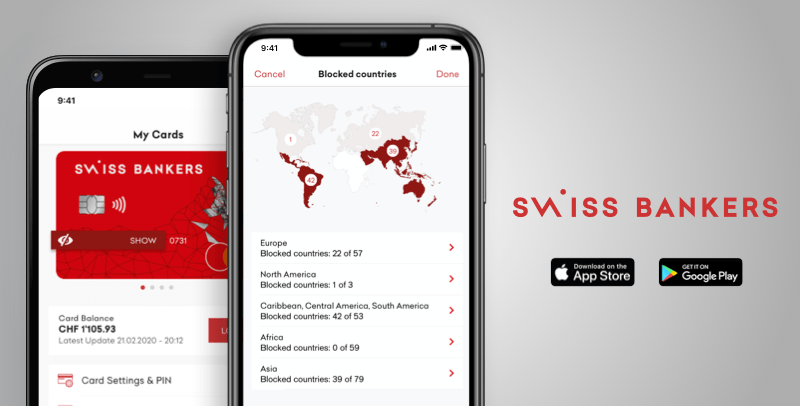

OpenPay™ ACS has been recently adopted by Swiss Bankers, a leading Issuer of prepaid cards in Switzerland. Dirk Blumenthal, CTO of Swiss Bankers, declared: “We were looking for an ACS that would be able to combine the strongest security standards and the highest quality of service, while, at the same time, aligning costs to our objectives, thanks to a cost model that rewards the increase in the approval rate. Although Opentech's newest solution, launched July 2021, is fully compliant with the strict security requirements of the PSD2, we have reached an approval rate over 90%, a value that is higher than the one we previously had with a non-PSD2- compliant solution. We are confident OpenPay ACS was the best choice we could have made.”

OpenPay™ ACS is part of the OpenPay suite, the best in class bouquet of services for Banks and card Issuers to boost digitization of payments.

-

29/01/2021

Happy birthday complete Control!

complete Control, the card management app and web portal of card complete - leader in credit card issuing in Austria - is celebrating its first birthday today.

complete Control is based on OpenPay™, Opentech’s flagship product whose evolution has been showcased at Finovate Europe in 2016, 2018 and 2020 and which has been chosen by major European Banks.

Twelve months have passed during which the innovative complete Control solution recorded performance beyond all expectations: from the first days up to today, the number of unique users who regularly use the new web portal and the mobile apps for iOS / Android has more than doubled, as has the satisfaction expressed by users on the stores, that has reached 4.8 stars on the Play Store and 4.6 on the App Store.

We are truly honored to work on such an important project for such a prestigious partner and we look forward to seeing the new complete Control features that will hit the market in the coming months.

From all of us at Opentech: happy birthday, complete Control!

-

12/12/2019

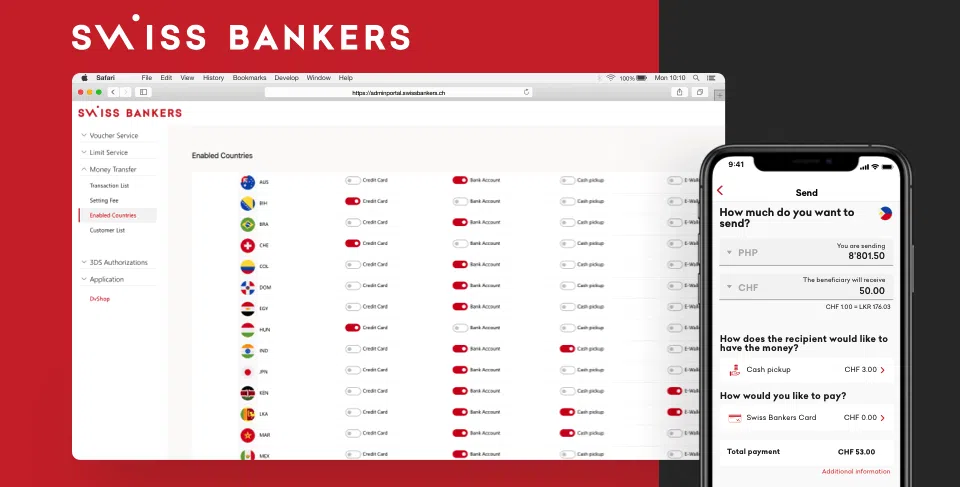

Swiss Bankers Enters the Money Transfer Market with Send

Swiss Bankers announces to the market the launch of Send, the innovative sending money service that allows the Swiss Issuer to significantly extend their market offering on digital channels.

Distributed within the My Card App, Send is a new feature that enables convenient, secure and transparent cross-border money transfers to multiple endpoints, including mobile wallets, bank accounts and any Mastercard card.

The service is currently available for all Swiss Citizens who own a Swiss Bankers card and can be activated through a quick and easy Know-Your-Customer procedure to be carried out in minutes directly from the mobile app.

Swiss Bankers' Send relies on OpenPay™ Send, the solution designed and operated by Opentech that leverages the Mastercard Send platform to provide a smart, convenient and use-case agnostic way to transfer money all over the world.

“We are proud to support a valuable partner such as Swiss Bankers during this important growth phase of their digital strategy” said Stefano Andreani, CEO of Opentech, “OpenPay™ Send is a powerful and flexible platform that leverages the Mastercard Send APIs to enable unlimited business opportunities while ensuring ease of integration and best-in-class security technologies. The release on the market of Send is an acknowledgment that testifies the quality of the work we have done and the reliability of our solutions.”

“The growing interest for simple peer-to-peer payments is a common factor in both the internal and the international market of payments.” said Hans-Jörg Widiger, CEO of Swiss Bankers, “Seizing this opportunity is a crucial step for us to remark and consolidate our positioning as a customer driven, trustable and innovative Company. With Send we faced this challenge, relying on our long-date partnership with Mastercard and Opentech to provide our Customers with a distinctive solution in line with our quality standards”.

-

06/12/2019

OpenPay™ Send hits the market, a solution based on Mastercard APIs that reshapes the future of sending money

Opentech released OpenPay™ Send, the first European solution in the world that combines the Mastercard Send APIs in a unique value proposition to bring sending money to the next level.

Through a single integration, OpenPay™ Send makes various types of money transfer possible - be it P2P, B2P, B2B or G2P - to reach more than 100 corridors, including up to three billion bank accounts and multiple other end-points such as mobile wallets, payment cards and cash-out locations across the globe. Whatever option is selected, this solution provides transparency, fast delivery times and a high level of convenience.

With OpenPay™ Send it’s the Bank’s business strategy that shapes the unlimited use cases that can be enabled, such as remittance services, payouts to gig economy workers, payouts to online marketplace sellers, distribution of insurance claims and humanitarian aid, real time P2P etc. In fact, thanks to OpenPay™ Send’s flexibility, the Bank is able to define various aspects of its offer, including the countries and the sending channels to be activated, as well as the price and the fees to be applied for each respectively. The solution includes a customizable User Interface for mobile and web, and an administration portal.

OpenPay™ Send is a market proven solution that relies on the multi-year partnership between Mastercard and Opentech, a synergistic relationship that is a guarantee of quick time to market, limited integration efforts and distinctive product experience.

“At Mastercard we designed the Mastercard Send platform envisioning a better, faster and smarter way to send money all over the world in multiple ways by leveraging our expertise and the existing relationships with our Customers. The launch of OpenPay™ Send brings this vision to life” said Arne Pache, Vice President Digital Payments & Labs at Mastercard

“Opentech’s mission is to be the enabler of digital payments for Banks, leveraging state- of-the-art infrastructures to build highly reliable and flexible solutions, ready to be deployed to the end-users” - said Stefano Andreani, CEO at Opentech - ”The partnership with Mastercard and the integration with their worldwide network is a perfect fit to our strategy, bringing a great value and convenience to our customers. Integrated in OpenPay™, Opentech’s well known suite of digital payment, OpenPay™ Send is an important addition to our offering.”

OpenPay™ Send will be demoed on February the 12th in Berlin, on stage at FinovateEurope 2020.

-

11/06/2019

The FICES project successfully concluded: now digital identity ... travels in Europe

Opentech and InfoCert announce that they have successfully completed the FICES project (First Italian Cross-border EIDAS Services, www.fices.eu), launched in 2018 with funding from the European Commission within the CEF (Connecting Europe Facility) program.

The project is the first pilot in the world that leverages the eIDAS authentication system to allow European Citizens to access payment, ticketing, and insurance services after a quick and secure onboarding process fully compliant with the regulations in force.

"The creation of an effective European Digital Single Market is an ambitious and challenging goal that requires building connections but also breaking down numerous barriers" - comments Stefano Andreani, CEO of Opentech. "Recognizing European digital identities for access to services provided by private parties, particularly in the financial sphere, requires a high level of mutual trust between the actors involved, which can only be acquired following trials of real use cases. FICES was not only a project with important technological contents but also allowed to address interoperability, compliance and user experience issues, experimenting with various solutions and gaining awareness. The Digital Single Market seems closer to us and we are ready, in the future perspective of a wide and homogeneous spread of eIDAS digital identities in Europe."

-

11/02/2019

Opentech supports Swiss Bankers to embrace the digital payment revolution with their new Digital Card

Today Swiss Bankers reached a major milestone in its digital payment strategy thanks to the revolutionary Digital Card product, the full-digital card that can be requested and activated in less than 5 minutes directly from the My Card app for Android (iOS version will be soon).

The Digital Card is issued with a promotional value of 5 CHF and it can be immediately loaded, to be used both for proximity payments with Samsung Pay and for e-commerce purchases.

The new app includes a full-digital process of KYC, to scan ID documents and verify users’ personal data, in order to extend the card’s limits.

Digital Card is built on top of OpenPay™, Opentech's full-stack payment solution: thanks to this product Opentech helps their Customers to innovate on the market through high value-added services that are characterized by a low impact on pre-existing IT infrastructures and a quick time to market.

-

20/03/2018

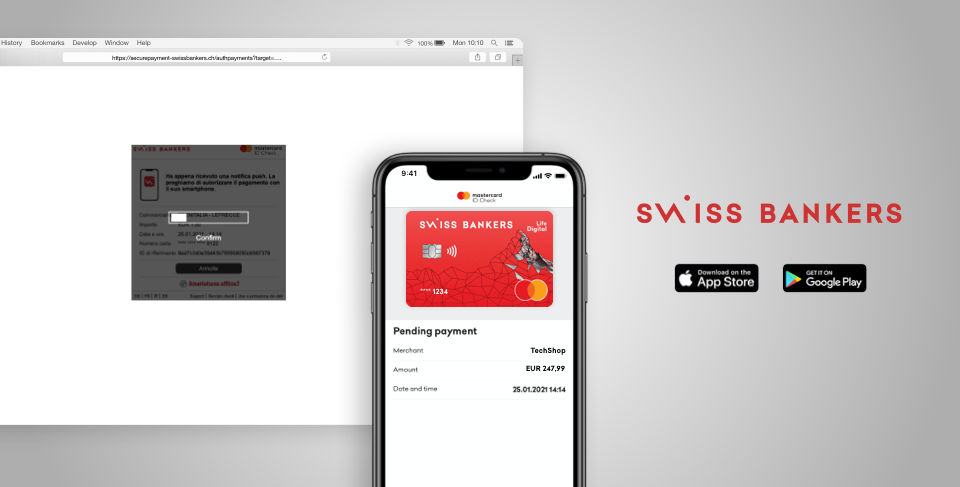

Swiss Bankers adopts OpenPay™’s 3DS Authentication System

Swiss Bankers launches the innovative OpenPay™'s 3D Secure Payment Authentication System. Thanks to this new feature, Swiss Bankers’ Customers can use the My Card app to live a seamless e-commerce experience. Here is how it works: during the checkout, as soon as Customers enter their card data, a push notification with the details of the pending payment is sent to the My Card app; in order to authorize the purchase, they just have to authenticate within their app (by using the biometric recognition system or the confirmation PIN they created) and the job is done. A fallback to SMS is also available, according to the user's preference.

OpenPay™ 3DS Protection System is integrated with the CA Technologies (Arcot Systems)’ ACS and is fully compliant with Mastercard Identity Check specifications.

-

28/02/2018

OpenPay™ for Business to be presented next week at Finovate Europe in London

Next week Opentech will be on the stage again at Finovate Europe in London to present OpenPay™ for Business, a suite of Payment Services tailored to the Enterprise market. The solution, which includes a web portal and dedicated mobile apps, has been designed to simplify companies’ daily activities by enabling valuable interactions between workers with different roles. Among the features that will be demoed: company performance analysis, expense tracking and receipt storage, payroll automation, management of company card limits and settings.

Stay tuned for updates!

-

20/02/2018

Opentech awarded Platinum Vendor in the Mastercard's worldwide Directory of Digital Wallet providers

We are pleased to announce that Opentech has been assigned Platinum Vendor status in the Mastercard Engage Directory for Digital Wallets. The Directory lists digital partners offering solutions to help Mastercard's customers digitize their card portfolios easily and quickly and deploy their own Digital Wallets. “We are honored of being recognized as a leading partner of banks in the digital transformation of payments - declared Stefano Andreani, CEO of Opentech – We see this as an acknowledgment of the user-centered strategy which leads our product development.

-

01/02/2018

Opentech expands their presence in the DACH region

We are proud to announce the official launch of Opentech Payment Services AG, our new daughter company with an operating office in Zug (Switzerland). A strategic move to enforce our presence in the DACH region as a payment service provider. Board Member Daniel Böhringer, a highly skilled professional with an extensive experience of 23 years in the payment industry, joined the challenge being in charge of the Business Development for this strategic market. "People embrace mobile payment applications when they have been designed with usability and security as top priorities - said Daniel – In Opentech I’ve found a team of talented people who can bring exciting innovations to our markets”

-

05/01/2018

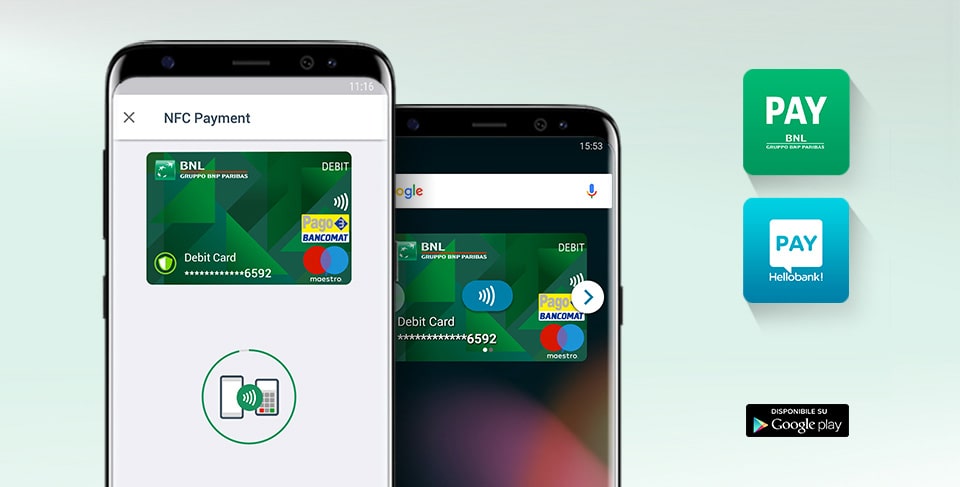

BNL PAY and Hello! PAY Android apps can now make NFC Payments

BNL PAY and Hello! PAY Android apps - customized versions of OpenPay™ live with BNL and Hello Bank! - now let you make proximity payments in all physical stores equipped with NFC POSs.

This brand new feature, that leverages the Mastercard Digital Enablement Service platform, provides you with three different payment patterns:

1 Manual Mode: choose your card from the app (or the dedicated widget) and pay with your fingerprint;

2 Automatic Mode: tap the POS to awaken the wallet with your favorite card pre-selected and complete the payment with your fingerprint by tapping the POS again;

3 Unlock & Pay: Just unlock the phone with the fingerprint and tap the POS to complete your payment.

Released on Google Play on January 5th, proximity payments are available for NFC-enabled devices with Android 4.4 or higher and work with all the Bank's Mastercard cards (credit, debit and prepaid).

-

30/03/2017

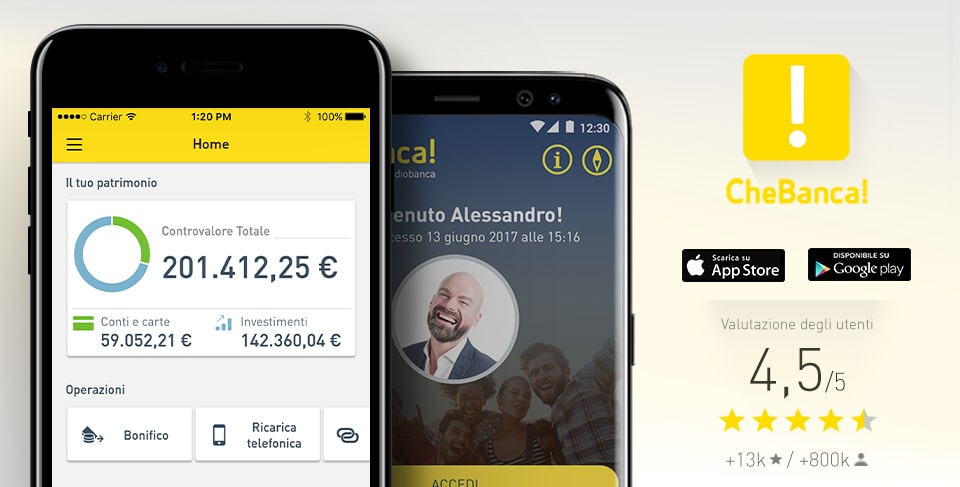

CheBanca! m-banking app released on stores

CheBanca!’s new mobile banking is available for download on app stores. Passionately welcomed by the market with a 4.5/5 score, this brand new version of the App has been completely redesigned to be the easiest, most personal and intuitive way to interact with the Bank. Among the new features:

• login with fingerprint without the hassle of entering the user code

• availability of products’ balance directly in the pre-login area

• product’s dashboard for asset management at a glance

• account customization with profile photo

The application is operated and hosted by Opentech within its Banking Grade Cloud Infrastructure, enabling high scalability and short time to market thanks to the adoption of CD / CI approaches.

-

29/09/2016

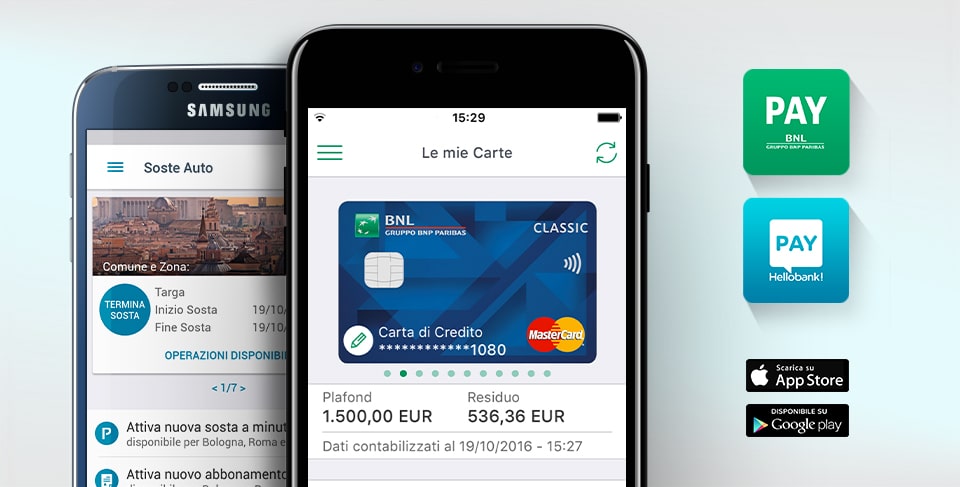

BNL PAY and Hello! PAY now available in Stores

We are proud to announce that from today the new wallet apps BNL PAY and Hello! PAY are available in stores. Based on a customization of the latest version of OpenPay™, these solutions provide BNL and Hello bank! customers with a value-rich set of features to control the expenses made with cards, make online purchases with Masterpass, send money with Jiffy and pay for parking with Smarticket.it. BNL PAY and Hello! PAY are available on iOS and Android devices and will soon be released on Windows Phone smartphones.

-

05/04/2016

New apps based on OpenPay™ for Swiss Bankers Prepaid Services Ltd

Swiss Bankers Prepaid Services Ltd, a major issuer of prepaid cards in the Swiss market, has fully renewed its mobile offering «My Card» with new functionalities based on a customization of Opentech’s OpenPay™. The solution is a feature-rich wallet that, thanks to the integration with the MasterCard inControl platform, enables an enhanced management of users’ cards.

Through an easy-to-use control panel, users can now temporarily put cards on hold and personalize the security settings of each card both by specifying the countries where transactions can be made and/or by enabling/disabling online purchases, online betting and gambling and NFC payments. In addition, users can set push or SMS alerts to be notified when a transaction is accepted or declined, when a minimum balance has been reached, and in case of card top-ups. Moreover, the user can add receipt photos and personal notes to transactions.

The solution is fully operated by Opentech within its PCI DSS certified infrastructure.

-

11/07/2015

WoW allows to pay for parking

Thanks to a partnership between CheBanca! and Smarticket.it, the mobile ticketing operator that plays as a hub between Banks and Public Transport Companies, WoW app can now be used to pay for parking.

Smarticket.it - the toll-parking service integrated within WoW - is currently available in Rome and Bologna, and will soon be extended to other major Italian cities.

Pay for parking with Smarticket.it is simple: after launching WoW, the user inserts the area where they want to park (also selectable by interactive map), the car plate and the duration (that can be changed at any moment). The payment is made only at the end of the parking period, with a direct charge on one of the payment tools that have been enrolled in WoW.

This new feature is also available for the newly arrived Apple Watch, WoW by CheBanca! starts its path towards the era of SmartCities.

-

10/07/2015

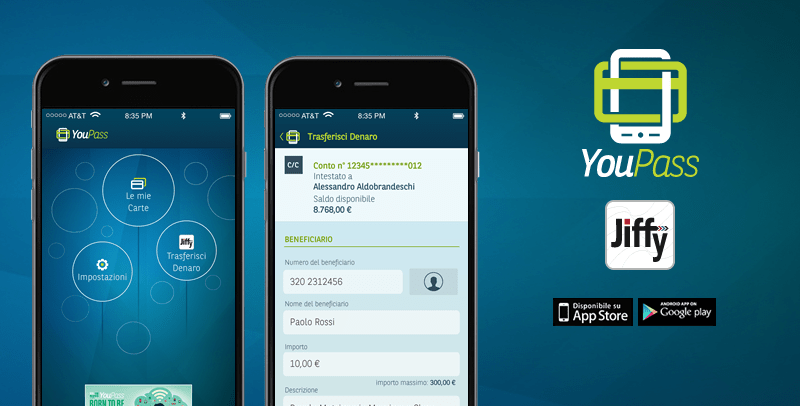

Jiffy is now available in YouPass by BNL

Jiffy, the Italian interbanking P2P payment service, landed on YouPass. Thanks to this new feature - available on both Android and iOS apps - BNL Customers can now send and receive money in real time using their mobile phone number. An easy and convenient way to solve little problems of everyday life such as splitting the dinner bill between friends or collecting money from a number of people for a group gift.

-

22/04/2015

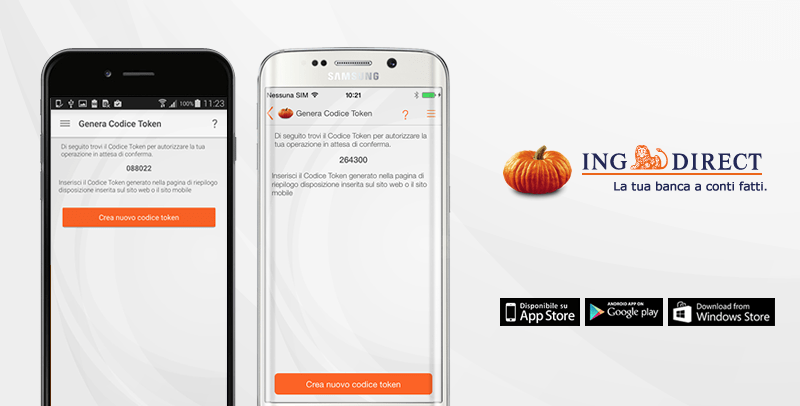

A renewed GUI and an important security update for the Italian ING DIRECT app

The latest version of ING DIRECT Italy’s mobile banking is available in stores with a new look and an important security update.

NEW LOOK. With a new graphical user interface - completely inspired by the best design standards of mobile platforms - the experience of ING DIRECT app is now more efficient and satisfying.

SECURITY UPDATE. The most important change, however, is the integration of a strong authentication service – designed and provided by Opentech - that replaces the Grid Card with a software token generator, a solution that makes the authorization of operations even easier and more secure.

-

30/09/2014

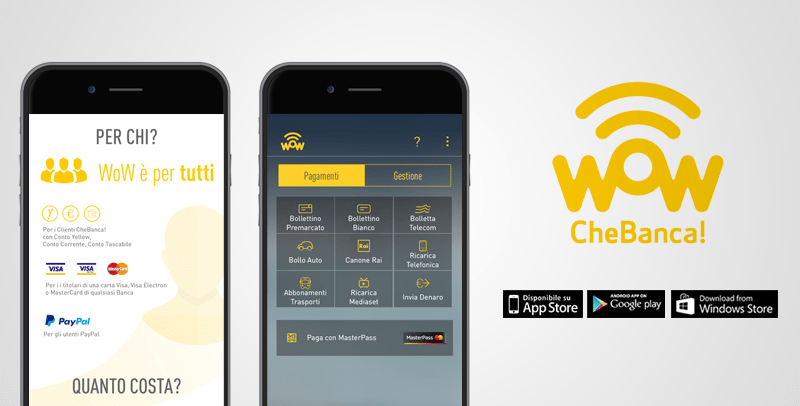

WoW by CheBanca! available in app stores!

OPENTECH is proud to announce the release of WoW in stores, the wallet app by CheBanca! that enables remote payments and e-commerce purchases using the smartphone as a means of authentication and authorization.

This app relies on OpenPay™, the end-to-end solution designed by OPENTECH to ensure a fast and profitable commercial rollout avoiding integration impacts on the existing IT structures of the Bank. Among the OpenPay™ services: Bill and postal slip payments, Top ups, Money sending, e-commerce purchases with MasterPass.

WoW is available on iOS, Android and Windows Phone for all the Customers of CheBanca! and Visa, Visa Electron or MasterCard cardholders.

- 1 2 Archive